Here’s how KIPP, a non-profit charter school, and its investors make money:

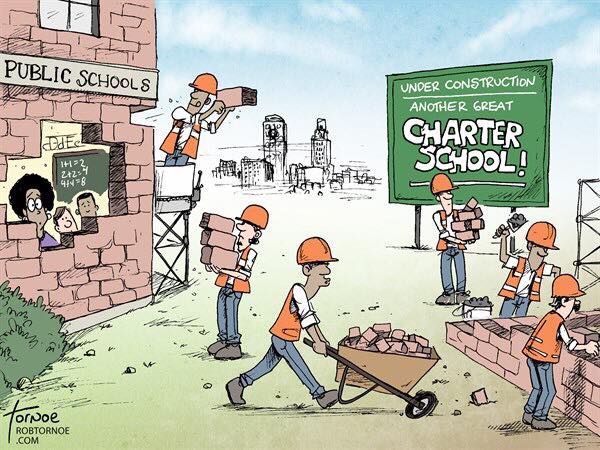

Last night at our board meeting, we discussed whether our district should oversee two new KIPP schools, which the appointed state Board of Education has forced upon on our district under the new state charter authorizer law. This was a test case for the new law that many believe is unconstitutional. The state authorizer law takes away local control of schools and requires our district to pay for the charter schools that they force us to open.

A few months ago, our school board denied the KIPP applications based primarily on fiscal impact and the lack of demand for more KIPP seats in Nashville. However, KIPP, showing zero respect for the decision of locally elected officials (all the while claiming it wants to "partner" with our district), appealed its applications to the state, which overturned us. Last night, we voted to allow the state to oversee the two KIPP schools which it has authorized.

During our meeting, I made the comment that the new state charter authorizer law was passed because there is a lot of money to be made off the backs of poor people. This irritated my board colleague, Elissa Kim (a Teach for America executive), who challenged me to explain how non-profit charter schools make money. I explained that there are many ways non-profit charters make money, including: (1) a 39% federal tax credit that allows investors to double their money in seven years; (2) all sorts of land deals, including using taxpayer money to fund land investments that profit the investor, not the taxpayers; (3) requiring students to purchase materials from board members at marked up prices or charging students high prices for lunches and other necessities; and (4) taking money from classrooms and driving it up to the top by, for example, hiring cheaper, inexperienced, uncertified teachers; by using computers instead of teachers for classroom instruction; or by using uncertified teachers for enrichment like art and music.

Ms. Kim continued to press me to cite examples of how KIPP makes money, specifically in Nashville, but our board chair cut off the discussion. Had we continued the discussion, I would have pointed out that all of the above examples apply to all charter schools, even those here in Nashville. However, to answer Ms. Kim’s questions, let's dig a little more deeply into this topic.

1. First of all, I am certain that local hedge funders and venture capitalists take advantage of the New Markets Tax Credit program, mentioned above. Investors in the KIPP charter chain would be fools not to seek the greatest possible return on their investment.

2. Second, with regard to KIPP's local finances, it's important to note that KIPP Nashville is a private corporation that is part of a national corporate chain of KIPP charter schools. The KIPP Foundation has amassed net assets of over $31 million, KIPP in New York has amassed about $18 million in net assets, and KIPP in Texas has amassed net assets over $22 million. Much of this money comes from grants from the federal government, some comes from charitable donations, and of course, KIPP is also funded by our tax dollars.

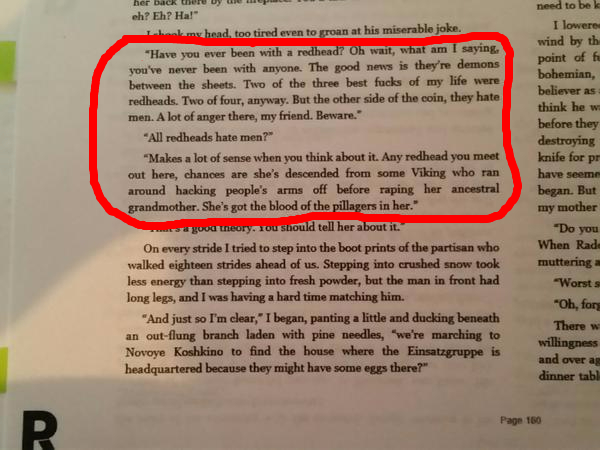

KIPP spends this money lavishly. Over a six-year period, the KIPP Foundation spent $16 million on travel- to such places as the Opryland Hotel, Disney Swan and Dolphin Hotel, Rio Suite Hotel and Casino, and Red Rock Casino (in Vegas). A local teacher who formerly worked at a KIPP school sent me this message: "During my one year at KIPP, I was stunned at the lavish spending sending everyone across the country to a summit in Las Vegas: hotels, convention spaces, food, drinks, entertainment, the whole deal, before the year even started! Then once the year started, no money for paper, no money for subs, and certainly no interest in any teachers staying long enough to see salary increases. It struck me as bizarre--I knew what flights to Vegas and hotels there cost--what could each teacher have done with that money for supplies???"

There are many ways (described in the article below in the comments) that KIPP leaders can also double or triple their income through the school network. For example, the co-founder of KIPP Foundation is simultaneously paid a six-figure salary for his work at the foundation, another six figure salary for consulting with KIPP Foundation (doing work that he ordered), and a third six figure salary for acting as superintendent of KIPP schools in NYC. His total annual salary is over $468,000. Not a bad income for serving “the poor,” as KIPP would have us believe.

On its most recent 990 form, KIPP Academy Nashville (the only local KIPP school for which I could locate 990 forms) lists $7.7 million in total assets and $5.3 million in net assets.

KIPP Nashville and KIPP Memphis each got a million dollars through federal Race to the Top grants. Also, KIPP Nashville received $2 million in 2012 from the Charter School Growth Fund to help with expansion. KIPP Memphis received $3 million in 2011 from the Charter School Growth Fund, which allowed it to expand to ten times its size. The Charter School Growth Fund is a Denver-based venture capital fund. (Venture capital funds exist to make money; a venture capital fund would not invest in a charter school without the expectation of a clear financial return on its investment.) As more charter schools open, less funding is available for traditional schools. This cripples traditional schools, creating more "failing" schools and more opportunities to expand charter schools, which can select their students in both obvious and subtle ways. This is the process of dismantling public education.

And then there's the special treatment that charter schools like KIPP receive. Back in 2010, former Nashville Mayor Karl Dean decided to set aside $10 million dollars of capital funding for *ONE* KIPP school. At that time, the district was suffering from the recession and sustained three years of no capital funds, placing us a billion dollars behind on capital needs. MNPS traditional schools were housed in buildings with holes in floors, exposed wiring, mold issues, and other major troubles, but KIPP received $10 million for just a few hundred students. (At that time, this particular school may have been serving less than one hundred students; I'm not certain.)

3. Third, Townes Duncan, a Belle Meade venture capitalist, is a founding member of KIPP Nashville’s board, and while he no longer serves on the board, he remains an active supporter of KIPP. Duncan owns a venture capital company called Solidus Company. Solidus has invested in a program called “LiveSchool,” which is now used by KIPP. This is how it works: Charter school board members can influence charter school purchases and programs and thus make a profit from the charter schools they manage.

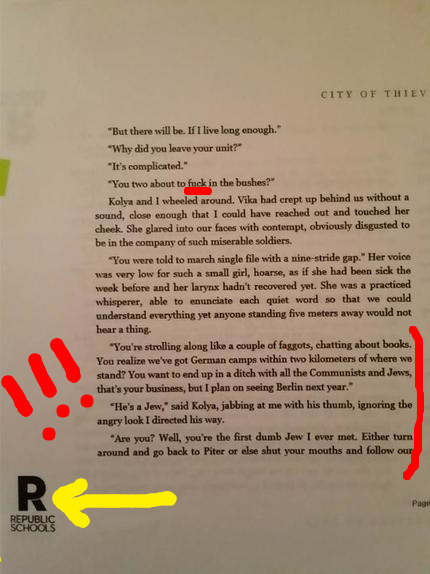

4. KIPP, locally and nationally, is staffed almost exclusively by Teach for America teachers. These young, inexperienced teachers are paid low salaries while working extreme hours, often 60-90 hours per week. Most TFA teachers, who get school loans paid off by TFA and enter a lucrative network for future careers when they leave TFA, quit the teaching profession after only a couple of years of teaching. This helps keep charter school staffing costs down. With TFA to supply a new crop of inexpensive new college grads yearly, there is no need for KIPP to develop long-term employees (who cost more money) or manage their own recruiting. TFA and schools like KIPP develop a symbiotic relationship and cannot survive without one another. Why? TFA contracts are being cut nationwide (MNPS cut the ranks of TFA teachers in half this year for low performance), and they now need charter schools to hire their recruits. Charter schools need TFA because they tend to overwork and underpay their teachers, and most teachers who have been through traditional training and certification tracks are not interested in working for charter schools. They can make more money and accrue better benefits working for traditional school districts.

So there you have it.

I’m sure this is just scraping the surface. I don’t know all the details of how KIPP operates or how it cuts costs. I don’t know if our local KIPP schools are involved in land deals that make money for investors. But one thing is certain: We would not have a charter authorizer law that takes away local control of schools if there were not heaps of money to be made from charter schools.

(Here's the board meeting. My comments start at 1:06, and the dialogue between me and Ms. Kim takes place at 1:10.)

https://www.youtube.com/watch?v=XM9W2QyT3RE#t=4211

http://www.dailykos.com/story/2014/04/08/1290529/-Is-public-school-for-sale-the-cost-of-KIPP

http://archive.tennessean.com/article/20130925/BUSINESS04/309260015/Nashville-s-LiveSchool-finalist-national-Startup-Year

http://www.schoolsmatter.info/2012/09/a-former-kipp-teacher-shares-her-story.html

https://seattleducation2010.wordpress.com/2012/03/25/a-former-kipp-teacher-comments-on-her-experience/

http://www.prnewswire.com/news-releases/liveschool-behavior-tracking-app-raises-165-million-in-series-a-funding-189166151.html

https://en.wikipedia.org/wiki/New_Markets_Tax_Credit_Program

http://www.bizjournals.com/nashville/blog/2013/12/with-2m-investment-kipp-nashville.html

http://www.schoolsmatter.info/2010/10/nashville-mayor-karl-dean-to-use-10.html

http://nashvillecitypaper.com/content/city-news/will-karl-deans-push-charter-schools-finally-make-him-education-mayor

RSS Feed

RSS Feed